We’re excited to bring you the weekly updates, insights, and opportunities to enhance your trading experience with Delta Exchange.

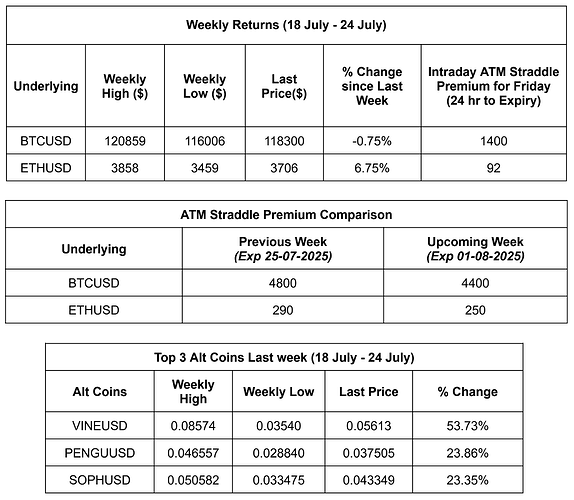

WEEKLY SNAPSHOT

Note: Last Price mentioned above are as observed on 24th Jul, 11:59 PM IST.

Trade Now!

CRYPTO NEWS

- On July 25, Bitcoin plunged below $116,000 in a sharp market downturn, triggering a widespread liquidation of crypto long positions worth nearly $600 million in 24 hours. Over 213,000 traders were liquidated, with Bitcoin and Ether accounting for the largest losses. The market drop, described as a “leverage flush,” followed a recent bullish sentiment after Bitcoin’s new ATH of $123,100. Despite the dip, the Crypto Fear & Greed Index still signals strong optimism with a score of 70. (Source: Cointelegraph)

- U.S. spot Bitcoin ETFs saw $226.6 million in net inflows on Thursday, July 24, breaking a three-day streak of outflows. Fidelity’s FBTC led the pack with $106.6 million, followed by VanEck’s HODL and BlackRock’s IBIT. Meanwhile, spot Ethereum ETFs continued their momentum, extending a 15-day inflow streak with $231.2 million added on the same day. (Source: The Block)

- SharpLink Gaming has appointed Joseph Chalom, a former BlackRock digital assets executive, as co-CEO. Known for leading BlackRock’s iShares Ethereum Trust launch, Chalom brings deep Ethereum expertise. Current CEO and co-founder Rob Phythian will transition to president. The move aligns with SharpLink’s focus on Ether adoption. (Source: Dow Jones Newswire)

- 35 public companies now hold 1,000+ BTC each, with institutional Bitcoin purchases up 35% in Q2 2025. The U.S. leads with 94 firms, and Bitcoin is increasingly used for payments and tokenization, not just investment. (Source: AInvest)

- On July 24, 2025, the crypto market saw $1 billion in liquidations in 24 hours, driven by a ~10% drop in altcoins, pulling total market cap down to $3.78T. Over 314,000 traders were liquidated. While U.S. and European markets showed profit booking, Asian markets led strong gains — especially in ETH, which surged 63% in a month. (Source: Cryptorank)

OPTIONS OI ANALYTICS FOR UPCOMING WEEK

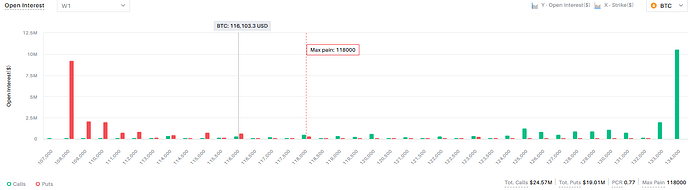

OI Analytics for the upcoming week: BTCUSD

Significant Put writing starts at 108,000 strike on the lower side while significant Call writing starts at 134,000 on the higher side. PCR of 0.77 points to a neutral market sentiment for the coming week.

OI Analytics for the upcoming week: ETHUSD

Significant Put writing starts at 3600 strike while there significant Call writing at 3800 on the higher side.PCR of 1.37 points to slightly bullish market sentiments for the upcoming week.

Trade Now!

USA WEEK AHEAD (IST) [HIGH IMPACT DATA]

- Wednesday - 6:00 PM - GDP Growth Rate

- Friday - 6:00 PM - Non Farm Payrolls , Unemployment Rate

If you need any assistance or have any questions, our dedicated customer support team is here to help you, please write to us here.

Happy Trading!

Delta Exchange Team