We’re excited to bring you the weekly updates, insights, and opportunities to enhance your trading experience with Delta Exchange.

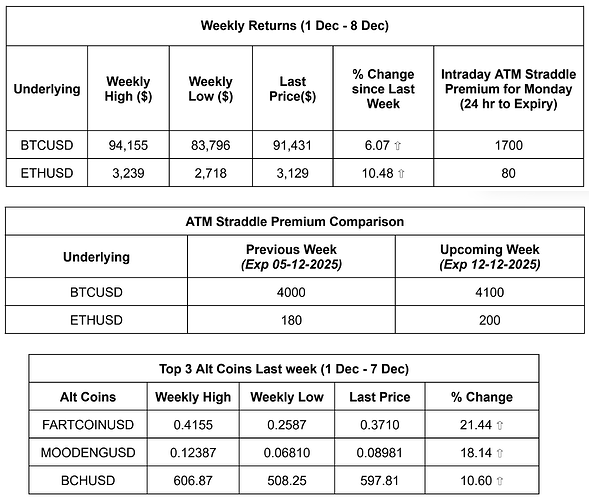

WEEKLY SNAPSHOT

Note: Last Price mentioned in Weekly Returns table are as observed on 8th Dec, 11:59 AM IST and those in the Top 3 Alt Coins table are as observed on 7th Dec, 11:59 PM.

Trade Now!

CRYPTO NEWS

-

On December 8, Bitcoin is hovering near a critical 0.382 Fibonacci support, with analysts warning a breakdown could send prices back to April lows around $76,000. Over the weekend, a leverage flush pushed BTC below $88K before rebounding above $91K, triggering mass liquidations. With the Fed’s rate-cut meeting and key U.S. data ahead, analysts say volatility remains high and upside momentum weak, though on-chain data shows seller exhaustion and renewed long-term holder activity, hinting at underlying bullish strength.

Source: CryptoNews -

Japan’s 20-year bond yield surged to 2.94%, its highest in nearly three decades, raising fears of a global liquidity pullback. With debt at 263% of GDP, Japan may need to repatriate up to $500B from global markets, pressuring U.S. Treasuries, Tether, and Bitcoin. Analysts warn that if yields stay above 2.9%, BTC could drop 5–8% toward the $87K support, though ETF inflows and pro-crypto U.S. policies may cushion the downside.

Source: Coinpedia -

Ethereum whales have opened $426 million in long positions as ETH holds above $3,000, signaling bullish sentiment ahead of the Dec. 10 Fed rate cut. Data shows major wallets and institutions like BitMine increasing exposure, while technical charts point to an ascending triangle breakout targeting $4,000, though resistance remains near $3,350–$3,800.

Source: Cointelegraph -

Last week, U.S. Bitcoin and Ethereum spot ETFs saw significant outflows of $87.7M and $65.4M, respectively, while Hong Kong Bitcoin ETFs recorded modest inflows. New ETF developments include Grayscale’s SUI filing, 21Shares’ 2x leveraged SUI ETF launch, and Franklin Templeton’s Solana ETF with staking rewards. Meanwhile, VanEck extended its BTC ETF zero-fee policy, Vanguard enabled crypto ETF trading, and Goldman Sachs acquired Innovator Capital to expand its Bitcoin-linked ETF offerings, signaling continued institutional interest despite outflows.

Source: Bitget -

Argentina’s central bank is reportedly considering changes that would let domestic banks trade and offer crypto services, reversing its current ban. The proposal, which could be approved by April 2026, aims to boost mass crypto adoption in the country. Argentina already ranks second in Latin America with $93.9B in crypto transactions, according to Chainalysis, trailing only Brazil, which recently tightened its crypto regulations.

Source: The Block -

Philippines’ GoTyme Bank rolled out crypto services for 11 assets, including BTC and ETH, via a simple peso-to-USD conversion. Focused on ease of use, the bank plans Southeast Asia expansion while prioritizing growth over profitability.

Source: Cointelegraph

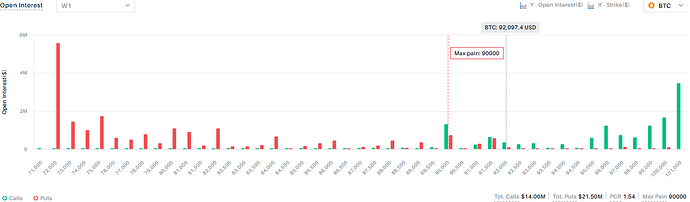

OPTIONS OI ANALYTICS FOR UPCOMING WEEK

OI Analytics for the upcoming week: BTCUSD

Significant Call writing starts at $96,000 level, while notable Put writing is evident at $82,000 on the lower side. The Put-Call Ratio (PCR) of 1.52 points to slightly bullish conditions for the upcoming week.

OI Analytics for the upcoming week: ETHUSD

Significant Call writing is observed at the $3,600 strike, while notable Put writing is evident at $2,200. The Put-Call Ratio (PCR) of 1.05 suggests a neutral market sentiment for the upcoming week.

Trade Now!

USA WEEK AHEAD (IST) [HIGH IMPACT DATA]

Tuesday, Dec 9

8:30 PM - JOLTs Job Openings

Thursday, Dec 11

12:30 AM - Fed Interest Rate Decision

01:00 AM - Fed Press Conference

If you need any assistance or have any questions, our dedicated customer support team is here to help you, please write to us here.

Happy Trading!

Delta Exchange Team