We’re excited to bring you the weekly updates, insights, and opportunities to enhance your trading experience with Delta Exchange.

WEEKLY SNAPSHOT

Note: Last Price mentioned above are as observed on 19th Jun, 11:59 PM IST.

Trade Now!

CRYPTO NEWS

- Bitcoin briefly surged above $106,000 after an unknown whale took a massive $255 million leveraged long position at 20x leverage, triggering significant short liquidations. This move helped BTC break through nearby resistance, reaching around $106,500, but traders remain cautious about whether the breakout will sustain. Key levels to watch include $100,000 and $110,000 for June, with $104,500 needing to hold to maintain a short-term bullish outlook. Similar large whale trades have influenced Bitcoin’s price action several times in May and June. (Source: Cointelegraph)

- U.S. spot Bitcoin ETFs have seen an eight-day net inflow streak totaling $2.4 billion, led by BlackRock’s IBIT fund, which accounts for 96% of the inflows. Since their January 2024 debut, Bitcoin ETFs have attracted $46.9 billion in net inflows with nearly $125 billion assets under management. In contrast, Ethereum ETFs’ previous 19-day $1.4 billion inflow streak ended last week, and inflows have slowed, with total Ethereum ETF inflows at $3.9 billion since launch. (Source: The block)

- Thailand will waive capital gains tax on crypto trades from January 2025 to December 2029, but only if conducted via locally licensed exchanges, aiming to boost its position as a global crypto hub. (Source: Finance Magnates)

- The U.S. Senate passed the GENIUS stablecoin bill in a 68-30 vote, pushing forward national crypto regulation despite concerns over Donald Trump’s ties to World Liberty Financial’s USD1 stablecoin. The bill now moves to the House. (Source: Cointelegraph)

- Bitcoin’s onchain activity has dropped to multi-year lows, but large transactions are rising, with whales and institutions now dominating base-layer transfers, according to Glassnode. (Source: The block)

OPTIONS OI ANALYTICS FOR UPCOMING WEEK

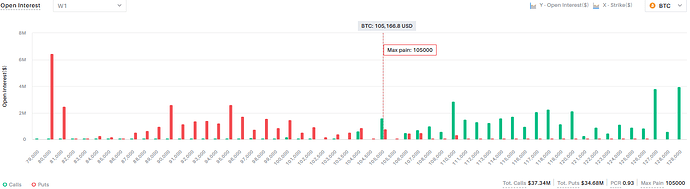

OI Analytics for the upcoming week: BTCUSD

Significant Put writing starts at 100,000 strike while significant Call writing starts at 110,000 strike. PCR of 0.92 points to a neutral sentiment for the coming week.

OI Analytics for the upcoming week: ETHUSD

Significant Put writing starts at 2200 strike while Call writing starts from 2900 strike. PCR of 1.01 points to neutral market sentiments for the upcoming week.

Trade Now!

If you need any assistance or have any questions, our dedicated customer support team is here to help you, please write to us here.

Happy Trading!

Delta Exchange Team