We’re excited to bring you the weekly updates, insights, and opportunities to enhance your trading experience with Delta Exchange.

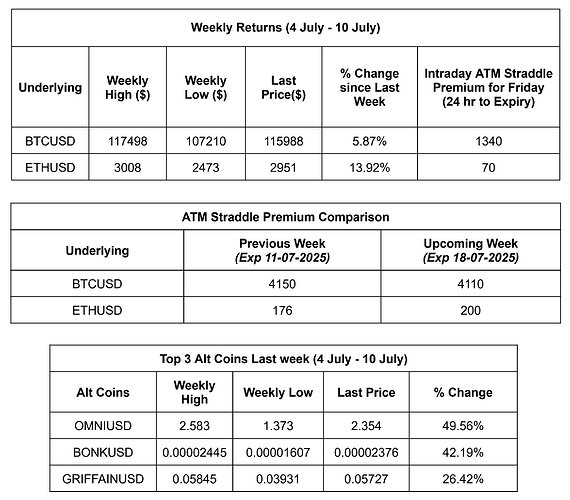

WEEKLY SNAPSHOT

Note: Last Price mentioned above are as observed on 10th Jul, 11:59 PM IST.

Trade Now!

CRYPTO NEWS

- Bitcoin surged 6.9% to hit a new all-time high of $118,408, driven by $1.18 billion in spot BTC ETF inflows—the second-highest daily inflow to date. Institutional demand is rising amid calmer macro conditions, anticipated U.S. interest rate cuts, and favorable regulatory changes like the GENIUS Act. Analysts suggest these factors could sustain momentum despite short-term risks. (Source: The Block)

- BlackRock’s iShares Ethereum ETF saw a record $301 million inflow on Thursday, pushing Ethereum past $3,000 for the first time since February. Ethereum ETFs have now attracted $6.1 billion in total inflows, leading the market. Overall, $383 million flowed into ETH ETFs Thursday, marking their second-best day since launch. High volumes and growing institutional interest suggest continued momentum. Meanwhile, spot Bitcoin ETFs also posted $1.17 billion in inflows, with BlackRock’s IBIT seeing $448.5 million, bringing its total to $53.4 billion. (Source: Crypto Potato)

- MicroStrategy (MSTR) stock rose 3.6% in premarket trading as Bitcoin hit a new all-time high above $118,000. The company now holds 597,325 BTC, worth ~$70.6 billion, up from a cost basis of $42.4 billion. Other crypto-related stocks like Coinbase, CleanSpark, and Marathon Digital also saw gains, driven by rising investor interest amid the bull run. (Source: Barron’s)

- On July 10, 2025, Ethereum futures volume ($62.1B) surpassed Bitcoin’s ($61.7B) for the first time in months, signaling a shift in trader sentiment and growing confidence in ETH. This surge is driven by institutional moves like Bit Digital converting its $173M BTC holdings to ETH, major whale accumulation, and anticipation of staking-enabled Ethereum spot ETFs. While Bitcoin remains the macro leader, Ethereum’s momentum suggests rising interest and potential for a breakout above $3,000. (Source: Crypto Potato)

- Altcoin season may be underway as 98% of altcoins outperformed Bitcoin over the past 48 hours, coinciding with a drop in BTC dominance from 66% to 64%. Whale accumulation, alongside ETF inflows favoring altcoins, suggests growing institutional interest. Ethereum’s price action remains key to confirming a broader altcoin rally. (Source: Coincentral.com)

OPTIONS OI ANALYTICS FOR UPCOMING WEEK

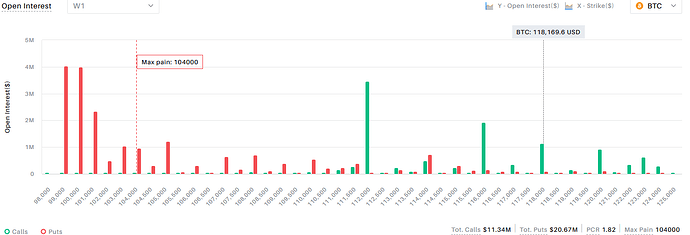

OI Analytics for the upcoming week: BTCUSD

Significant Put writing starts at 101,000 strike while there is no significant Call writing visible on the higher side. PCR of 1.482 points to a bullish sentiment for the coming week.

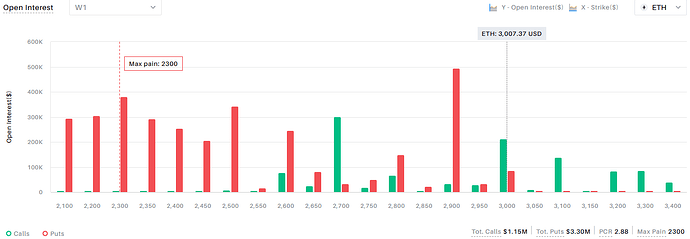

OI Analytics for the upcoming week: ETHUSD

Significant Put writing starts at 2900 strike while there is no significant Call writing visible on the higher side. .PCR of 2.89 points to bullish market sentiments for the upcoming week.

Trade Now!

USA WEEK AHEAD (IST) [HIGH IMPACT DATA]

- Tuesday - 6:00 PM - Core Inflation Rate

- Wednesday - 6.00 PM - Purchasing Price Index (MoM)

- Thursday - 6:00 PM - Retail Sales (MoM)

If you need any assistance or have any questions, our dedicated customer support team is here to help you, please write to us here.

Happy Trading!

Delta Exchange Team