We’re excited to bring you the weekly updates, insights, and opportunities to enhance your trading experience with Delta Exchange.

WEEKLY SNAPSHOT

Note: Last Price mentioned above are as observed on 17th Jul, 11:59 PM IST.

Trade Now!

CRYPTO NEWS

- On July 18, 2025, Ethereum surged past $3,600 after over $136 million in ETH shorts were liquidated, with analysts calling it a “regime change.” Strong ETF inflows and progress on U.S. crypto legislation helped boost market sentiment. Options traders are targeting $4,000 ETH by July 25, while the broader crypto market cap hit $3.94 trillion. Despite gains, investor sentiment remains elevated but not euphoric. (Source: The Block)

- XRP hit a new all-time high of $3.64 on July 18, 2025, breaking its 7-year record from 2018. Its market cap surged to $212 billion, making it the third-largest cryptocurrency, overtaking Tether. The rally was fueled by a 135% spike in spot volume, massive derivatives activity, Ripple’s push into regulated finance, progress on its stablecoin RLUSD, and hopes of a settlement with the SEC. Institutional interest and the potential for a U.S.-listed XRP ETF also contributed to the bullish momentum. (Source: crypto.news)

- SharpLink Gaming, backed by Joseph Lubin, has expanded its share offering to $6B to buy more ETH. It has already purchased $515M worth of ETH in the last 9 days, now holding over 280,000 ETH, mostly staked. SharpLink aims to eventually hold 1 million ETH (~1.38% of supply), becoming the largest corporate ETH holder, surpassing the Ethereum Foundation. Despite this, its stock (SBET) dropped nearly 5% after hours. (Source: Cointelegraph)

- On July 17, 2025, the U.S. House passed three major crypto bills, including the GENIUS Act, which mandates fully backed stablecoins, annual audits, and clearer regulations. The Digital Asset Market Clarity Act establishes oversight roles for the SEC and CFTC, while the Anti-CBDC Act blocks the Fed from issuing a retail central bank digital currency. SEC Chair Paul Atkins and crypto leaders like Coinbase’s Emilie Choi praised the bipartisan support, calling it a turning point for U.S. leadership in digital finance. The GENIUS Act now heads to the Senate and is expected to be signed by President Trump soon. (Source: The Block)

- Ethereum has outpaced Bitcoin in July with a 44% rally from $2,373 to over $3,526, driven by rising institutional demand and strong ETF inflows totaling 79,674 ETH (~$256M). This includes major accumulation by iShares and a 9% stake purchase in an ETH treasury firm by Peter Thiel. Meanwhile, Bitcoin dominance has dropped 5.4% to 62.47%, potentially signaling the start of an altcoin season. If ETH/BTC breaks above 0.038 BTC, analysts believe Ethereum could take the lead in the next market cycle. (Source: 99Bitcoins)

- Donald Trump is set to sign an executive order allowing 401(k) retirement plans to invest in crypto, gold, and private equity. The move could reshape the $9T U.S. retirement market by expanding beyond stocks and bonds. It follows his pro-crypto stance and reverses Biden-era restrictions. (Source: Financial Times)

OPTIONS OI ANALYTICS FOR UPCOMING WEEK

OI Analytics for the upcoming week: BTCUSD

Significant Put writing starts at 110,000 strike on the lower side while significant Call writing starts at 124,000 on the higher side. PCR of 2.53 points to a bullish sentiment for the coming week.

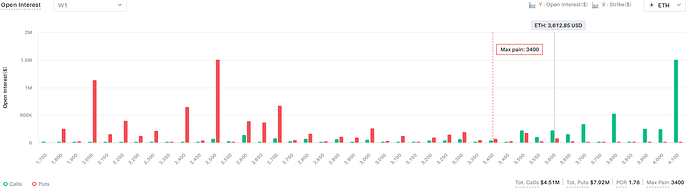

OI Analytics for the upcoming week: ETHUSD

Significant Put writing starts at 2700 strike while there significant Call writing at 4100 on the higher side. .PCR of 2.09 points to bullish market sentiments for the upcoming week.

Trade Now!

NEW PRODUCT FEATURE: TRACKERS

We have something special for you this week.

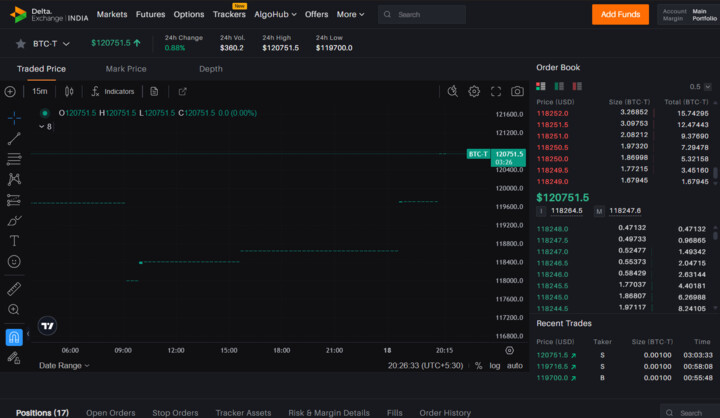

Introducing BITCOIN Tracker - A Smarter Alternative to Spot Trading!

Trackers are derivative contracts designed to closely follow the price movements of crypto assets, providing a similar experience to buying those assets directly in the spot market. By purchasing and holding a Tracker, you can benefit from any upward price movements of the underlying coin, and you have the flexibility to sell your Tracker at any time to realize your gains.

This product is designed as a seamless alternative to spot trading, giving investors direct exposure to crypto assets without the hassle of custody management. Ideal for those seeking simplicity, tax efficiency, and institutional-grade execution.

Key Features:

-

Lower Trading Fees

Lower Trading Fees

Cost-effective execution with ultra-competitive fees. -

Tax Efficiency

Tax Efficiency-

No 1% TDS

-

No flat 30% tax

-

Loss offset allowed as per capital gains framework.

-

-

Daily Tracking Cost

Daily Tracking Cost

A small daily cost applies to maintain exposure through the tracker. -

No Custody Required

No Custody Required

Tracker assets cannot be withdrawn, ensuring simplicity and security. -

No Leverage. No Shorting.

No Leverage. No Shorting.

Pure long-only exposure—ideal for passive crypto investors.

Use Trackers Now!

USA WEEK AHEAD (IST) [HIGH IMPACT DATA]

1.Tuesday - 6:00 PM - Fed Chair Powell Speech

If you need any assistance or have any questions, our dedicated customer support team is here to help you, please write to us here.

Happy Trading!

Delta Exchange Team